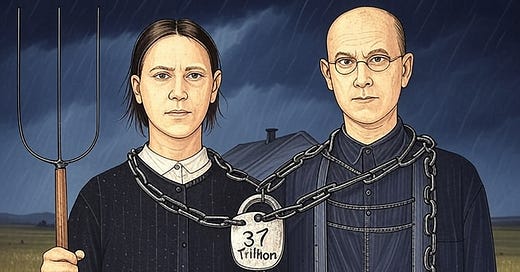

The $37 Trillion Question

Episode 5: Global and Domestic Consequences - How $37 Trillion Debt Reshapes America

A weekly series examining how America broke its postwar promise of fiscal responsibility. Each week, we trace the bipartisan policy choices that created today's debt crisis and explore evidence-based solutions that could restore fiscal sanity. This analysis is updated regularly with the latest economic and political developments.

By March 2025, America's national debt stands at $37 trillion—a fiscal colossus casting shadows both domestically and internationally. This isn't merely an accounting problem or abstract economic concept. The debt's consequences ripple through every aspect of American life: from the grocery store checkout where families feel inflation's sting, to boardrooms where CEOs navigate trade uncertainties, to foreign capitals where allies question America's long-term reliability.

Decades of Democratic spending and Republican tax cuts have birthed consequences that stretch from Washington to Ottawa, from Wall Street to war zones around the globe. Domestically, inequality festers while trust in institutions crumbles, creating the conditions for movements like MAGA that thrive on economic resentment. Internationally, wars drain resources that could fund infrastructure, trade relationships buckle under policy uncertainties, and America's once-unassailable leadership position weakens with each trillion added to the debt.

As a Canadian observing from across our shared border, I witness a superpower fraying at the edges. Our economies remain deeply interconnected—when America's fiscal house shakes, we all feel the tremors through currency fluctuations, trade disruptions, and investment uncertainties.

The tragedy is that these consequences were entirely predictable and largely avoidable. While Democrats built structures that endure—Social Security, Medicare, interstate highways—Republicans' relentless tax cuts carved deeper fiscal wounds than even the most ambitious spending programs. Both parties contributed to bending the postwar balance, but the weight of evidence tips toward choices that favored concentrated wealth over broad-based prosperity.

Domestic Inequality: The Fracturing of American Society

At home, the debt's toll manifests most visibly through unprecedented inequality that threatens the social fabric itself. The numbers tell a stark story: the top 1%'s wealth share soared from 22% in 1980 to 38% by 2020 according to Federal Reserve data—a direct legacy of Republican tax cuts that promised shared prosperity but delivered concentrated riches.

The Stagnation of the Middle Class

While the wealthy accumulated unprecedented fortunes, median household income stagnated at roughly $65,000 in constant 2020 dollars—barely above 1980 levels despite massive increases in productivity and economic output. This disconnect between growing economic output and stagnant middle-class wages reflects policy choices that channeled gains upward rather than distributing them broadly.

The Gini coefficient—economists' standard measure of inequality—hit approximately 0.48 by 2020, up from 0.35 in 1980. This places America among the most unequal developed nations, with income distribution resembling developing countries more than peer economies like Canada (Gini: 0.31), Germany (0.32), or France (0.33).

Geographic and Social Fragmentation

Inequality doesn't just create income gaps—it fragments society geographically and socially. Wealthy Americans increasingly cluster in expensive metropolitan areas where high-paying jobs concentrate, while struggling communities face declining economic opportunities and deteriorating infrastructure.

This geographic sorting creates what political scientists call "political geography polarization." Wealthy, educated Americans cluster in Democratic-leaning cities while struggling communities gravitate toward populist movements that promise simple solutions to complex problems. The result: political coalitions divided by economic experience rather than shared interests.

The Rise of Economic Resentment

These conditions created fertile ground for the MAGA movement that emerged in 2016 and peaked by 2025. Economic resentment—driven by decades of stagnant wages while billionaires multiplied—provided the emotional fuel for political extremism.

Trust in government collapsed from 73% in 1964 to 17% by 2024 according to Gallup polling. This erosion reflects genuine grievances: while ordinary Americans struggled with health care costs, student loans, and housing affordability, the wealthy received tax cut after tax cut that promised benefits that never materialized for average families.

Analysis: The correlation between rising debt levels and declining social trust isn't coincidental—it reflects policy choices that prioritized elite interests over broad-based prosperity, creating the conditions for political instability.

Economic Fragility: The Brittleness of Debt-Fueled Growth

America's massive debt burden creates economic fragility that constrains policy options and amplifies crisis impacts. Interest payments now consume roughly 18% of federal tax revenue—rising toward 25% by decade's end. This represents a fundamental shift in government capacity: every dollar spent servicing past debt is unavailable for education, infrastructure, healthcare, or future crisis response.

Constrained Crisis Response

The 2008 financial collapse demonstrated how fiscal irresponsibility constrains crisis response. When recession struck, federal debt had already reached dangerous levels due to Bush's tax cuts, limiting the government's ability to respond aggressively. Obama's necessary $831 billion stimulus and bank bailouts pushed debt past $10 trillion, but insufficient fiscal space meant the response was smaller than optimal.

COVID-19 repeated this pattern on a larger scale. Trump's pre-pandemic $1 trillion deficits—generated during economic expansion through unnecessary tax cuts—meant America entered its worst health crisis in a century with fiscal resources already strained. Biden's $1.9 trillion American Rescue Plan was necessary but pushed debt to unprecedented peacetime levels.

The Interest Rate Trap

Rising debt creates an "interest rate trap" where higher borrowing costs exponentially increase government expenses. If interest rates rise from current levels to historical averages, debt service costs could consume 30-35% of federal revenue within a decade—effectively paralyzing government operations.

This vulnerability means Federal Reserve policy must consider debt sustainability alongside traditional economic management. The central bank cannot normalize interest rates without triggering fiscal crisis, limiting its ability to combat inflation or manage economic cycles effectively.

Slower Economic Growth

High debt levels correlate with slower economic growth across multiple channels. Government investment in infrastructure, education, and research—proven drivers of long-term growth—must compete with debt service for resources. Private investment suffers as government borrowing crowds out business financing.

Economic growth averaged 4% during the postwar era (1945-1980) when debt remained manageable, but fell to 2% after 2008 as debt levels soared. This represents trillions in lost economic output that could have funded debt reduction, infrastructure investment, or tax relief for middle-class families.

Demographic Time Bomb

America faces a demographic transition as baby boomers retire and require increased Social Security and Medicare benefits. These obligations—already straining federal budgets—will accelerate debt accumulation unless policymakers implement structural reforms.

Current projections show debt-to-GDP ratios reaching 150-200% within two decades without policy changes. At those levels, America would resemble Greece before its fiscal crisis—dependent on international creditors and vulnerable to market confidence collapses.

Global Costs: Wars, Trade Disruptions, and Declining Leadership

Internationally, America's fiscal irresponsibility has imposed enormous costs on global stability while undermining the nation's leadership position. The pattern is consistent: military interventions financed through borrowing rather than taxation, trade policies driven by domestic political pressures rather than economic logic, and alliance relationships strained by unreliable policy commitments.

The True Cost of Forever Wars

America's military interventions since World War II reveal how fiscal irresponsibility enables poor strategic decisions. The Korean War cost roughly $30 billion, Vietnam approximately $150 billion, while Iraq and Afghanistan consumed over $2 trillion according to Congressional Budget Office analysis.

The pattern shifted decisively after Reagan's tax cuts. Earlier conflicts—Korea under Truman, the early Vietnam buildup under Kennedy—were financed through existing tax structures that forced political leaders to weigh costs against benefits. Later wars—Iraq, Afghanistan, Libya interventions—were financed entirely through borrowing, removing political constraints on military adventurism.

This "borrowing for war" dynamic enabled strategic disasters like Iraq's occupation and Afghanistan's nation-building experiment. Without immediate fiscal pain, political leaders could pursue ambitious military objectives without securing sustainable public support. The result: costly failures that drained resources while achieving minimal strategic objectives.

Trade Policy Chaos

America's trade relationships have suffered as domestic inequality—fueled by fiscal policy failures—created political pressures for protectionist responses. Trump's tariff wars, which initially escalated to 145% on Chinese goods before settling at current 30% rates, exemplify how domestic fiscal dysfunction exports global instability.

These trade disruptions impose real costs on allies and trading partners. Canada faced $20 billion in export uncertainty during Trump's NAFTA renegotiation and subsequent tariff threats. Our $400 billion annual trade relationship with America—representing millions of jobs across both countries—suffered due to policy unpredictability driven by domestic political pressures.

European allies experienced similar disruptions as American trade policy became increasingly erratic. The $22 billion in retaliatory tariffs imposed by the EU during 2025's trade conflicts reflected genuine frustration with American policy instability that threatened established economic relationships.

Declining Alliance Leadership

Perhaps most significantly, America's fiscal irresponsibility has undermined its alliance leadership position. NATO allies increasingly question whether America can maintain long-term commitments given its debt trajectory and domestic political instability.

Canada provides a useful comparison. Our defense spending reaches $20 billion annually—roughly 1.3% of GDP—while maintaining fiscal sustainability through higher tax rates on wealthy citizens. We prove that responsible fiscal policy can coexist with alliance obligations and international leadership.

America's approach—maintaining massive military spending while cutting taxes on the wealthy—creates unsustainable commitments that allies recognize as unreliable. When fiscal crisis eventually forces military spending reductions, alliance relationships will suffer accordingly.

Currency and Financial Stability Risks

The dollar's reserve currency status has protected America from immediate consequences of fiscal irresponsibility, but this privilege creates dangerous complacency. International confidence in American fiscal management affects global financial stability through several channels:

Reserve Currency Vulnerability

Central banks worldwide hold roughly $7 trillion in dollar-denominated reserves, providing America with extraordinary financing flexibility. But this privilege depends on continued confidence in American fiscal management. If international creditors begin diversifying away from dollars, financing costs could spike rapidly.

Recent trends suggest this diversification has already begun. China reduced Treasury holdings from peak levels, while even close allies like the UK decreased dollar reserves from $1.1 trillion in 2021 to $779 billion by 2025. These shifts reflect growing concern about America's fiscal trajectory.

Financial Market Instability

America's debt levels create systemic risks for global financial markets. Government bonds serve as "risk-free" assets that anchor international investment portfolios. If Treasury securities lose their safe-haven status due to fiscal concerns, global investment strategies would require fundamental restructuring.

The VIX fear index hit 35 during April 2025's tariff chaos—triple its normal range—as investors fled to safe assets. However, if Treasury bonds themselves become risky due to fiscal concerns, this traditional flight-to-safety mechanism breaks down, amplifying crisis impacts globally.

International Monetary System Strain

America's fiscal irresponsibility strains the international monetary system that has provided stability since Bretton Woods. As debt levels rise, other nations increasingly question why they should subsidize American consumption through dollar holdings while their own taxpayers fund domestic priorities responsibly.

China's development of digital currency alternatives and Europe's efforts to create dollar-independent payment systems reflect growing desire to reduce dependence on American fiscal policy. These developments could gradually erode the dollar's privileged position, forcing America to fund deficits through domestic savings rather than international subsidy.

Figure X: Dollar Reserve Currency Share vs. US Debt Levels (2000-2025)

US National Debt (Trillions USD) Dollar Share of Global Reserves (%)

The declining dollar share of global reserves correlates with rising US debt levels, threatening America's 'exorbitant privilege' that has enabled decades of deficit spending. As debt soars from $5.6 trillion to $36.2 trillion, dollar dominance falls from 71% to 57.4% of global reserves.

Social and Political Consequences

The debt crisis's domestic political consequences may prove more dangerous than its economic impacts. Fiscal irresponsibility has created conditions for political instability that threaten democratic governance itself:

Polarization and Extremism

Economic inequality—driven by tax cuts that benefited the wealthy while debt accumulated—provides the material basis for political extremism. MAGA movement supporters aren't responding to abstract ideological appeals but genuine economic grievances created by decades of policy choices favoring concentrated wealth.

Similarly, progressive movements demanding massive government spending reflect frustration with public investment neglect while resources flowed to wealthy taxpayers through repeated tax cuts. Both extremes represent rational responses to irrational fiscal policies.

Institutional Erosion

Trust in government institutions has collapsed as their effectiveness diminished due to resource constraints. Federal agencies struggle to fulfill basic responsibilities—from infrastructure maintenance to regulatory oversight—while serving debt that originated from political choices rather than public investments.

This creates a vicious cycle: reduced government effectiveness justifies further tax cuts and spending reductions, which further reduce effectiveness and justify additional reductions. Eventually, government becomes so weakened that basic functions suffer, confirming anti-government ideologies while creating genuine governance problems.

Democratic Accountability Breakdown

Debt financing enables political leaders to promise benefits without imposing costs, breaking the democratic accountability mechanism that traditionally disciplined fiscal policy. Voters receive tax cuts or spending increases while costs are deferred to future generations who cannot vote on current policies.

This temporal mismatch between political benefits and fiscal costs undermines democratic governance by severing the connection between policy choices and their consequences. Politicians can pursue unsustainable policies without facing immediate political penalties, creating systematic bias toward fiscal irresponsibility.

International Comparisons: The Road Not Taken

Other developed nations demonstrate that alternative fiscal approaches deliver superior outcomes:

Canadian Fiscal Responsibility

Canada maintains a 53% combined federal-provincial top tax rate while achieving better fiscal outcomes than America. Our debt-to-GDP ratio stands at 85% compared to America's 130%, while funding universal healthcare, comprehensive social programs, and infrastructure investment.

Canadian fiscal policy proves that higher taxes on the wealthy can coexist with economic growth, social cohesion, and international competitiveness. Our approach—asking those who benefit most from economic success to contribute proportionally to its maintenance—delivers fiscal sustainability without sacrificing prosperity.

European Models

Germany maintains a 47% top tax rate while achieving export surpluses and fiscal stability. France funds extensive social programs with 45% top rates while maintaining economic competitiveness. Nordic countries combine high tax rates with exceptional quality of life and strong economic performance.

These examples prove that America's fiscal crisis represents policy choice rather than economic inevitability. Higher taxes on the wealthy—the postwar American approach—can fund government operations while maintaining growth incentives.

The Compound Nature of Fiscal Damage

Perhaps most importantly, America's fiscal crisis demonstrates how bad policies create compound damage over decades:

Interest Compounds Every dollar borrowed to finance tax cuts or unnecessary spending generates interest obligations that require additional borrowing, creating exponential debt growth that eventually overwhelms government capacity.

Political Precedents Compound Each tax cut or spending increase without corresponding revenue creates political precedents that make future fiscal responsibility more difficult. Interest groups expect continued benefits while opposing revenue measures necessary to fund them sustainably.

Economic Distortions Compound Fiscal irresponsibility creates economic distortions—inequality, speculation, reduced public investment—that worsen over time and become increasingly difficult to reverse through normal policy adjustments.

International Consequences Compound Reduced American leadership capacity creates global instability that eventually affects American interests through trade disruptions, alliance weakening, and crisis contagion that requires expensive responses.

The Path Forward Requires Acknowledgment

Addressing America's fiscal crisis requires honest acknowledgment of how current conditions developed. Both parties contributed—Democrats through spending programs inadequately funded, Republicans through tax cuts that failed to generate promised revenue. But the evidence clearly shows that tax cuts, particularly those benefiting the wealthy, created larger structural deficits than spending programs that at least delivered public benefits.

Recovery requires rejecting the policies that created today's crisis and embracing proven alternatives that other nations have successfully implemented. The postwar American model—progressive taxation funding strategic investments—delivered superior growth and stability until political leaders abandoned it for untested theories that failed repeatedly.

Next week, we'll examine how Trump's tariff policies—pitched as solutions to America's fiscal crisis—actually worsen underlying problems while imposing additional costs on American families and businesses. Tariffs represent the latest attempt to avoid fiscal responsibility through policies that promise easy solutions but deliver economic chaos.

The $37 trillion debt crisis isn't America's inevitable destiny—it's the predictable result of specific policy choices that can be reversed through evidence-based alternatives. But change requires acknowledging how we arrived at this dangerous crossroads and rejecting the ideological blinders that prevented recognition of obvious problems.

Next week: Episode 6 - "Tariffs Won't Fix This: Why Trump's Trade War Makes Everything Worse"

How do you see the debt crisis affecting your daily life and community? What international consequences concern you most? Share your thoughts in the comments below.